Why Uruguay?

Uruguay is a country located in the south-east of South America, in a strategic area within MERCOSUR. It has an area of 176,215 square kilometers, with a population formed entirely of European descendants, with a 97% literacy. Uruguay is a favorable country when it comes to investing and doing business, being a safe and stable place to produce and negotiate.

It has political and economic stability, respect for contracts and property rights, as well as an independent and efficient justice. The Uruguayan state guarantees the free transfer of capital and profits abroad with free convertibility of the currency. It supports and benefits companies that promote investments in their territory through the law of investment promotion and the law of industrial parks.

Strategic Location

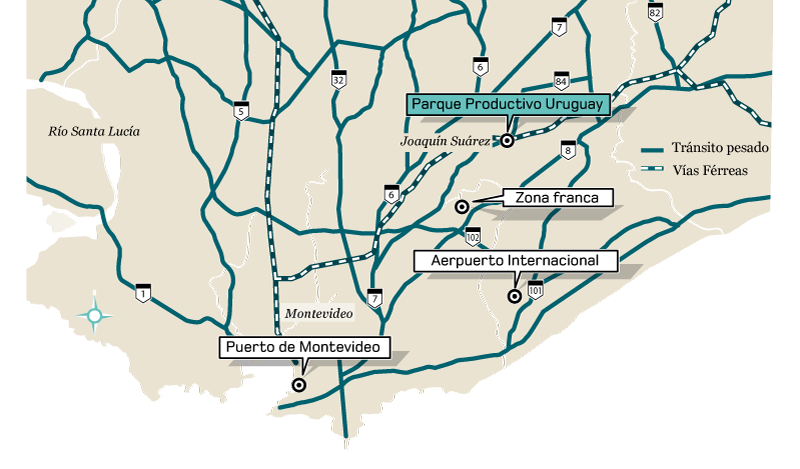

The Productive Park Uruguay has a strategic location on the departmental limit between Canelones and Montevideo.

It is located at km 27.200 of national route 74, 10 minutes from Carrasco International Airport; 30 minutes from the Port of Montevideo, 5 km from the ring collector and through it to the main access arteries to Montevideo, and the main National Routes, also having access by rail to the Port of Montevideo and into the interior of the country, Argentina and Brazil.

Notable benefits

Self channeling of savings

The self-channeling of savings that allows the company to deduct from its income tax the amount invested up to 50% and exemption from income tax of up to 100% of the amount actually invested.

Tax exemption

The total exoneration of the property tax and the exemption of taxes on the importation of goods and services.

Fiscal benefits

The possibility of obtaining up to an additional 15% in tax benefits, as a user of industrial parks. And the possibility of obtaining a tax credit for employers' contributions (approximately 8% of the salary cost), up to 5 years.